Real estate is a dynamic and lucrative industry that offers substantial opportunities for investors, agents, and property managers. However, the complex financial transactions and regulatory requirements involved in real estate can be overwhelming without proper bookkeeping. That’s where real estate bookkeeping services come into play. In this blog post, we’ll explore the vital role of these services in the real estate sector.

The Importance of Real Estate Bookkeeping

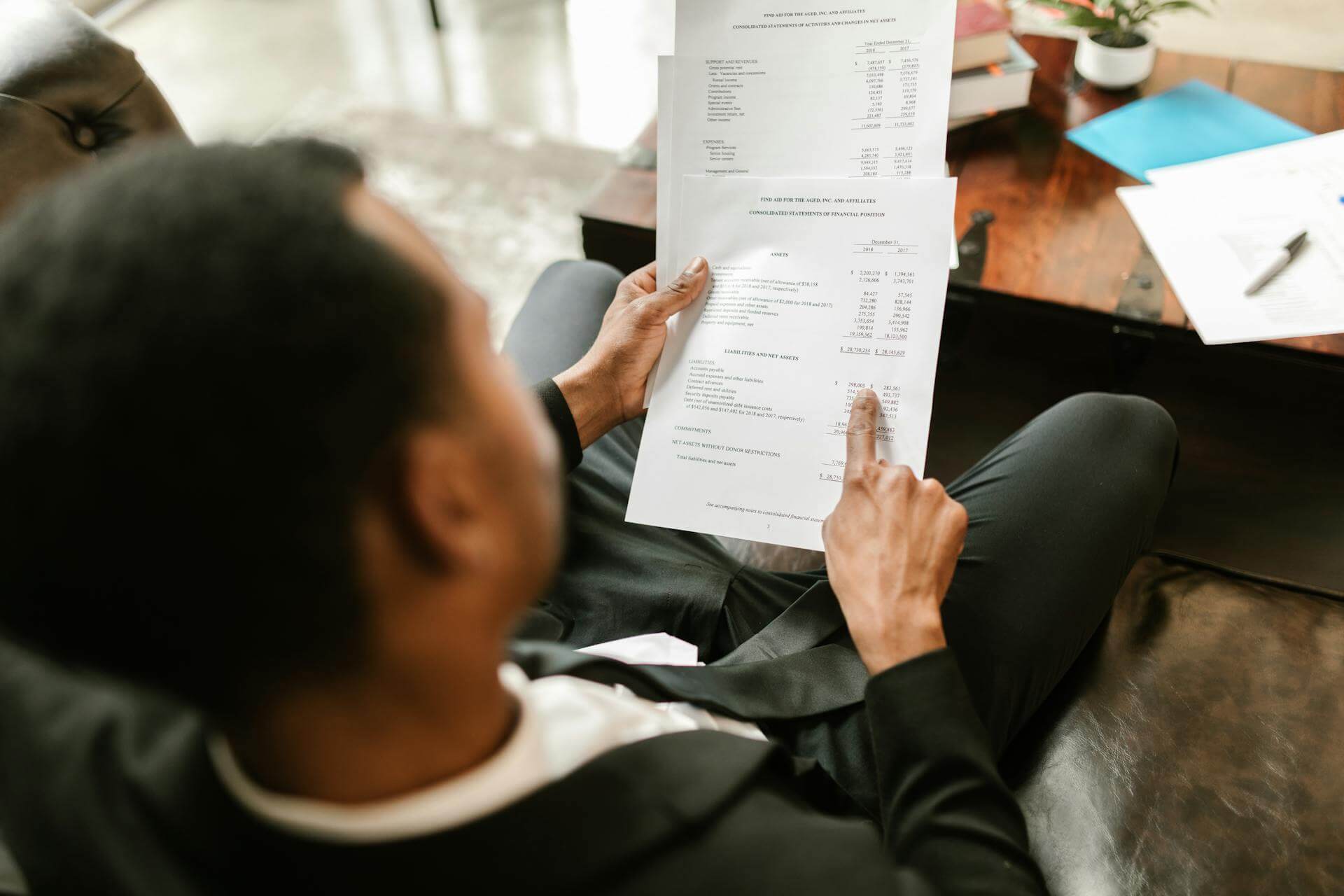

Effective bookkeeping is the backbone of any successful real estate venture. It involves recording and organizing financial data, tracking income and expenses, and ensuring compliance with tax regulations. Here are some reasons why real estate professionals should consider outsourcing their bookkeeping:

- Financial Clarity: Accurate and up-to-date financial records provide a clear picture of a real estate business’s financial health. This information helps in making informed decisions, identifying areas for improvement, and setting realistic financial goals.

- Time Savings: Managing the finances of a real estate business can be time-consuming. By outsourcing bookkeeping tasks, professionals can focus on their core competencies, such as property acquisition, client relationships, and property management.

- Compliance and Tax Benefits: Real estate bookkeepers are well-versed in tax laws and regulations specific to the industry. They can help minimize tax liabilities and ensure compliance, reducing the risk of audits and penalties.

- Scalability: As your real estate business grows, so does the complexity of your financial transactions. Professional bookkeeping services can adapt to your evolving needs, ensuring seamless scalability without sacrificing accuracy.

Key Services Provided by Real Estate Bookkeepers

- Income and Expense Tracking: Bookkeepers record all income sources, including rent payments, commissions, and other revenue streams. They also meticulously track expenses, such as property maintenance, utilities, and mortgage payments.

- Bank Reconciliation: Reconciling bank statements with financial records is crucial for detecting discrepancies and preventing errors.

- Budgeting and Forecasting: Bookkeepers can help create budgets and financial forecasts, enabling real estate professionals to plan for the future and allocate resources effectively.

- Financial Reporting: Real-time financial reports provide valuable insights into the financial performance of your real estate investments. These reports can help identify trends and areas for improvement.

- Tax Preparation: Bookkeepers can work in tandem with tax professionals to prepare and file tax returns, maximizing deductions and minimizing liabilities.

Choosing the Right Real Estate Bookkeeping Service

When selecting a real estate bookkeeping service, consider the following factors:

- Industry Expertise: Look for bookkeepers with experience in the real estate sector, as they will be familiar with industry-specific nuances.

- Technology Integration: Ensure that the service uses modern accounting software and tools for efficiency and accuracy.

- Reputation and References: Check reviews and ask for references to gauge the quality and reliability of the service.

Conclusion

OPTIMALBooks, LLC plays a pivotal role in helping real estate professionals manage their finances effectively. By entrusting your bookkeeping tasks to us, individuals and businesses can streamline their operations, reduce financial stress, and position themselves for long-term success in the dynamic world of real estate. Make the wise choice today and partner with OPTIMAL, LLC to unlock the full potential of your real estate ventures.