In recent years, the property management industry has witnessed a remarkable trend: a surge in acquisitions of property management firms. This growing trend is reshaping the landscape of the industry and providing both opportunities and challenges for firms, investors, and property owners. In this blog post, we’ll explore the factors driving the rise of property management firm acquisitions and the implications of this trend.

Market Fragmentation

One of the primary drivers behind the increase in property management firm acquisitions is the fragmentation of the market. The property management industry comprises numerous small and medium-sized firms, making it highly competitive. Large firms are capitalizing on this fragmentation by acquiring smaller firms to expand their portfolios, gain market share, and achieve economies of scale.

Portfolio Expansion

Property management firms that engage in acquisitions can quickly expand their property portfolios. This expansion allows them to offer a wider range of services, attract more clients, and generate higher revenues. For investors and property owners, it can mean access to a larger pool of potential tenants and enhanced property management expertise.

Geographic Expansion

Acquisitions provide an excellent opportunity for property management firms to enter new geographic markets. Rather than building a presence from scratch, acquiring an established local firm allows for immediate access to a new market, including its clients, properties, and local expertise.

Improved Efficiency

Combining operations through acquisitions can lead to cost savings and improved efficiency. Large property management firms can streamline their operations, reduce overhead, and negotiate better deals with service providers. These benefits can be passed on to property owners in the form of cost-effective property management services.

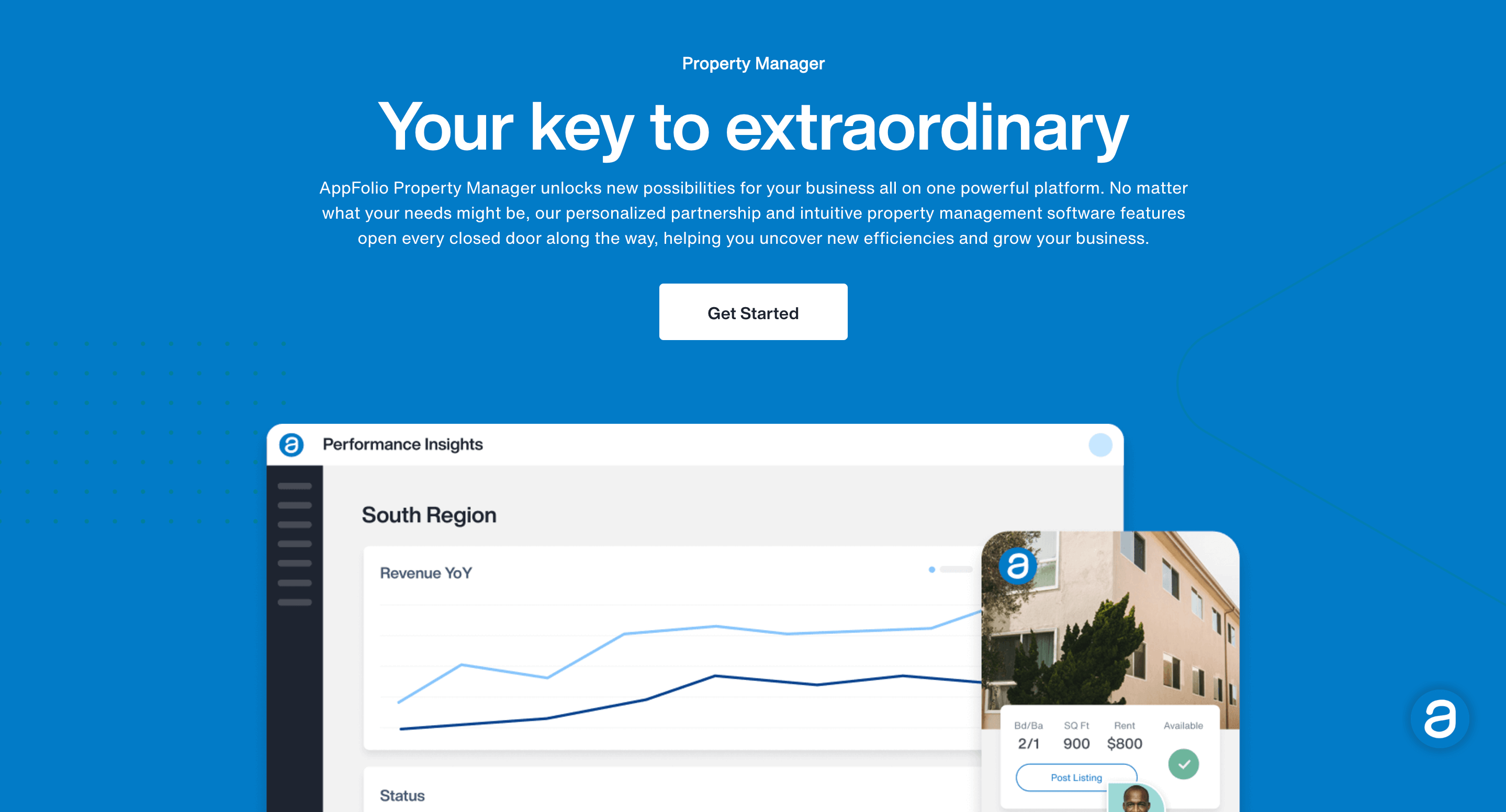

Enhanced Technology

As the property management industry becomes increasingly tech-dependent, acquiring smaller firms often means acquiring their technology solutions. This technology can be integrated into larger operations, providing access to advanced software, online platforms, and digital tools that enhance the client experience.

Implications

While the rise in property management firm acquisitions offers several benefits, it also poses challenges. Smaller firms that get acquired must adapt to new management structures, potentially impacting their existing client relationships. Property owners and investors should carefully evaluate the implications of these acquisitions to ensure that their needs and expectations are met.

Conclusion

The dramatic upswing in property management firm acquisitions has ushered in a transformative season within the property management space. By harnessing OPTIMAL’ scalable back-office solution, firms can take advantage of the opportunities in their local markets. OPTIMAL can help firms bolster their market presence, expand their property portfolios, and elevate the quality of services they provide in a more scalable and cost-efficient way. It is important for all stakeholders to deliberate the implications of these acquisitions, ensuring they align with their core values and overarching objectives. As the property management sector continues its trajectory, property management firms and astute investors, alongside OPTIMAL, will be able to dominate their current market and move into ancillary ones.